Plastic Pressure Pipes Europe

The market for infrastructure pipes is reputed for its conservatism. At AMI Consulting, we disagree with such characterisation. Despite caution, over the years we’ve seen tremendous changes, which are revolutionary. Almost every metre of low pressure gas distribution pipe installed in Europe has been plastic pipe. If nothing else, this example shows unequivocally that the market recognises, accepts and rewards valuable innovation. This will continue to drive demand for plastic pipes for both gas and pressure water systems, despite considerable economic challenges.

Plastic pipes offer a lower environmental impact than alternative materials and governments in Europe are targeting water leakage to ensure water efficiency by investing resources into identifying and repairing pipe leaks. The future of the industry is dependent on new standards and regulations, new solutions and inter-material competition trends. Understanding these is key to aligning effort, resource and product, and as a knock on – achieving success.

The future of the industry is dependent on new standards and regulations, new solutions and inter-material competition trends. Understanding these is key to aligning effort, resource and product, and as a knock on – achieving success.

Report scope

Application scope and segmentation

The study encompasses the following application segments:

- Pipes for supply and distribution of drinking water.

- Pipes for low pressure transmission and distribution of natural gas.

- The demand for fittings and accessories is also quantified, as an additional ‘application’.

To enable a more useful analysis, the demand for and production of pipes are segmented by diameter range.

Thus, the market for drinking water pipes is segmented into the following diameter ranges:

- Less than 89 mm

- 90-179 mm

- 180-299 mm

- 300-499 mm

- More than 500 mm

The data for gas pipes is segmented into the following diameter ranges:

- Less than 89 mm

- 90-179 mm

- More than 180 mm

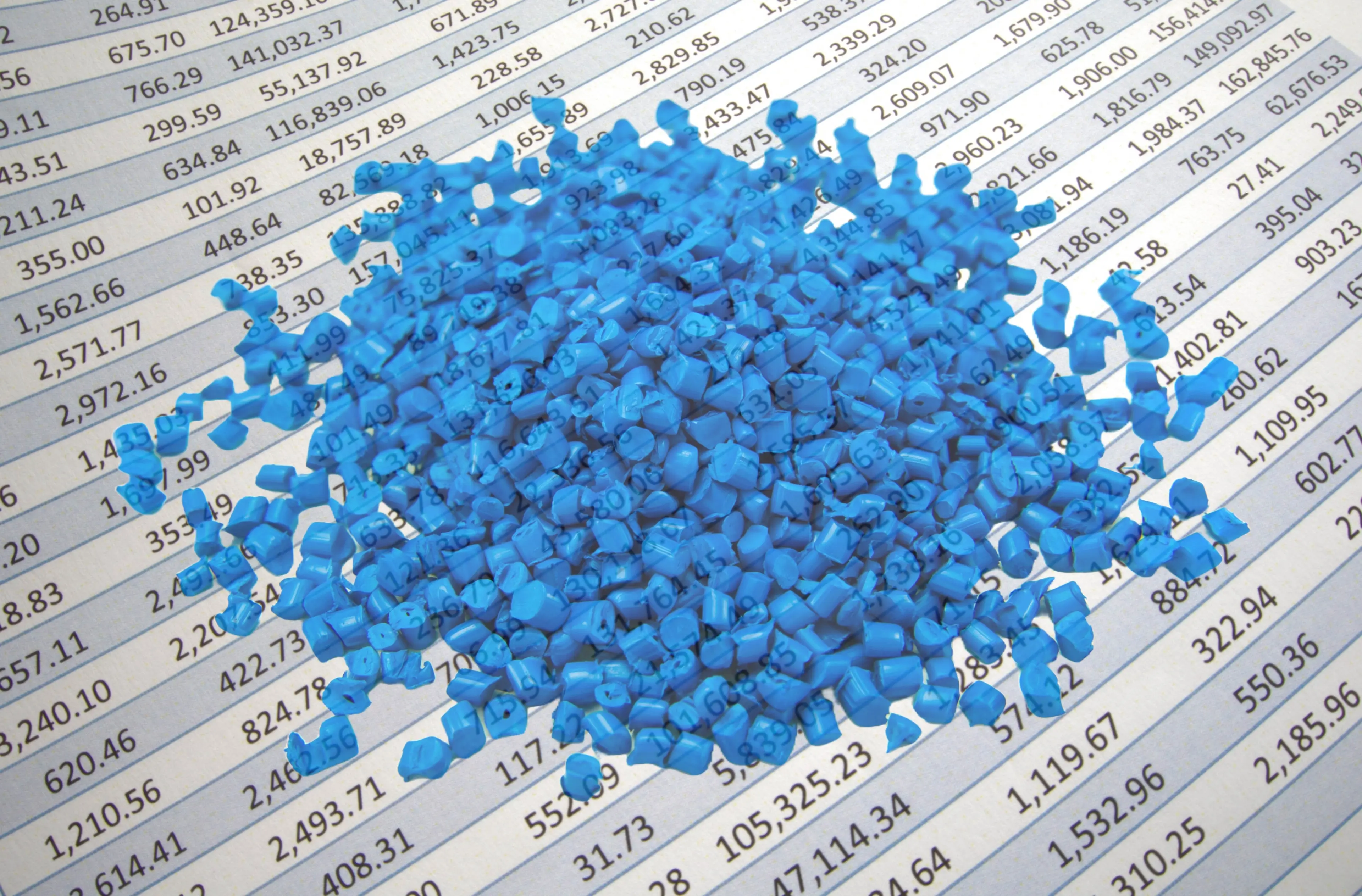

Materials scope

The study covers the demand for pipes made of the following materials:

- PVC (including u-PVC, m-PVC, and o-PVC)

- PE 80

- PE 100

- PE 100 RC (including, at this stage, PE100RD)

- Ductile iron

Data points

The study provides demand data for 2016, 2019, 2020, 2021, 2022, and 2026. It was published in March 2022.

Require updated data? We can design customised market reports that meet your exact needs.

Geographical scope

For the purpose of this report, Europe is defined as the European Union (27 countries), as well as Iceland, Norway, Switzerland and the UK.

To enable meaningful analysis, the 31 countries were divided among France, Germany, Italy, UK, Benelux, Nordic countries, Spain, Poland, other occidental countries (OOC), and other Central and Eastern European countries (OCEE).

Enquire now

To receive the report proposal, sample pages and more information, contact us today.

Related market intelligence

Magazine Market Report